LCV Editorial November 2014

LCV Marketplace

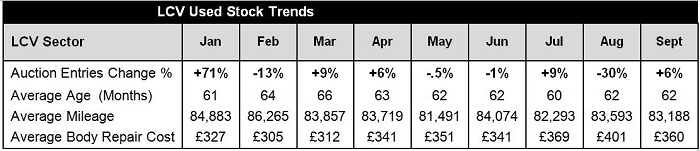

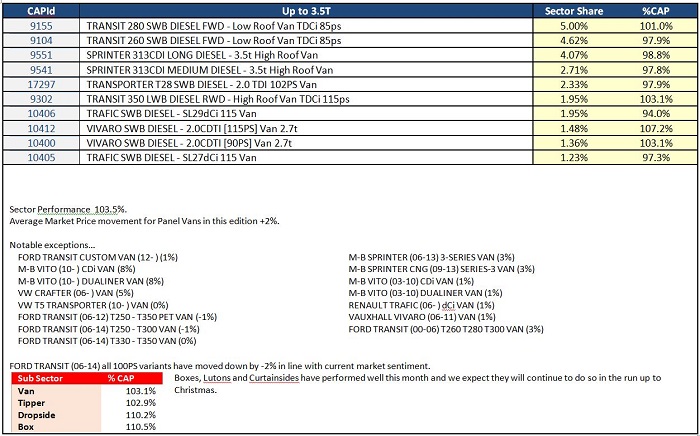

The limited supply of stock we reported last month continued throughout October with very low entries from some of the larger vendors fuelling suspicion that the market is heading for a supply crisis and putting upward pressure on prices. From our observations at the auctions we attended there was a clear sense of urgency to acquire stock amongst professional buyers which at times led to fierce competition and resultant price spikes in our auction sales research data. It also became apparent that there was a willingness to pay over the odds for vehicles irrespective of their condition. This was particularly evident in the large panel van sector and we witnessed many examples of vehicles exhibiting substantial panel damage selling well above CAP Average values.

It could be argued that the shortages we are currently witnessing are temporary and it’s nothing more than a case of history repeating itself since we saw a similar supply issue at exactly the same point last year. Furthermore, when you consider the number of new LCVs registered each year as the economy recovered from recession, the number of 3-5 year old LCVs that could potentially enter the used LCV wholesale market has been increasing year on year. Based on new registration figures and the typical vehicle replacement cycles we’ve seen in recent years, we can only conclude that the current supply issues will be short-lived.

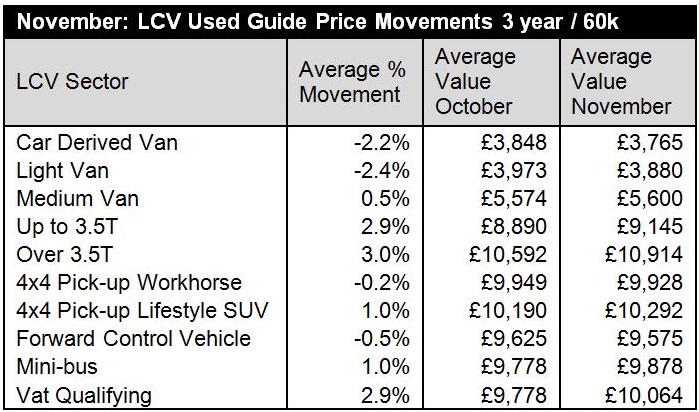

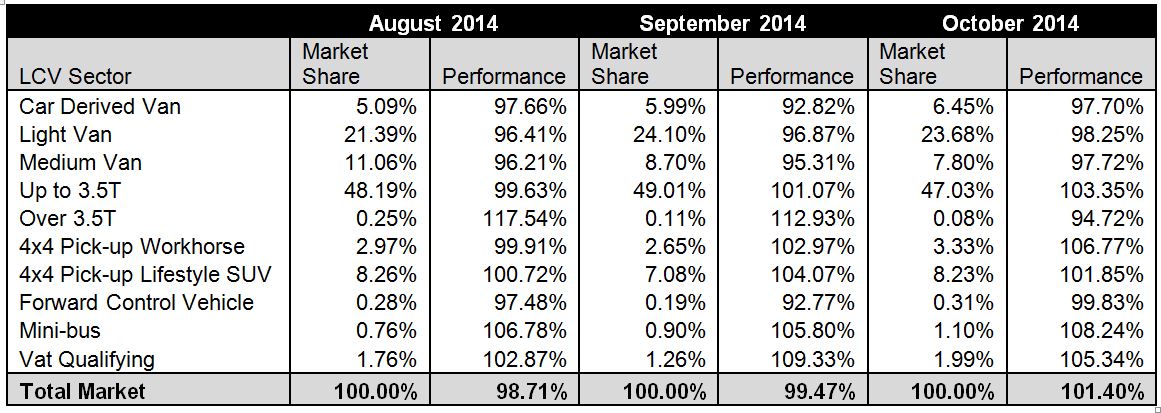

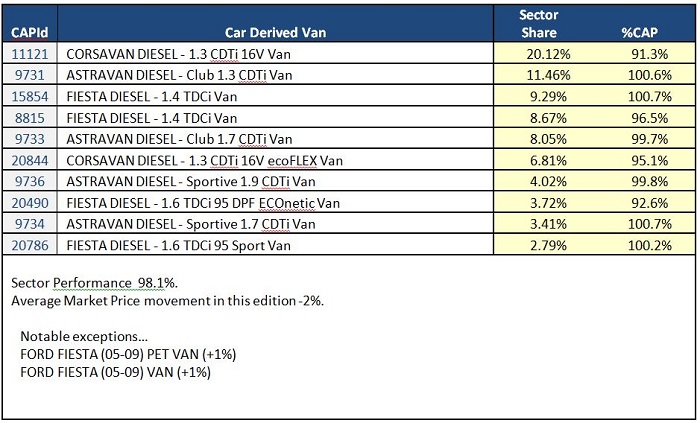

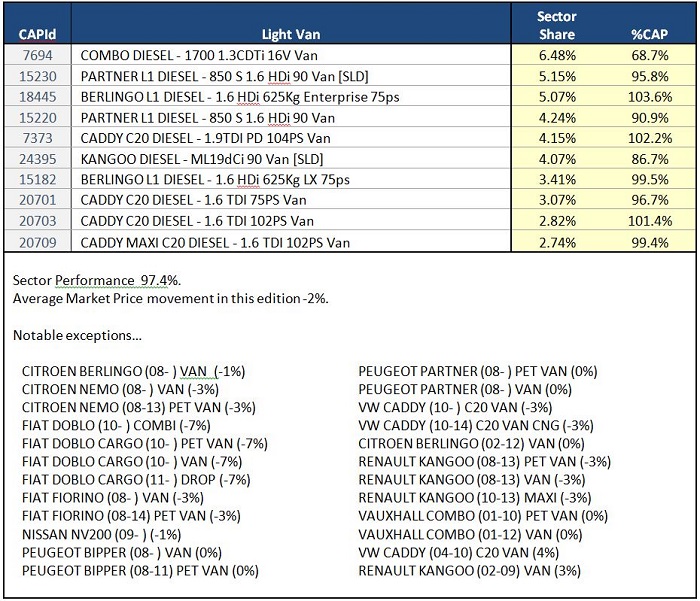

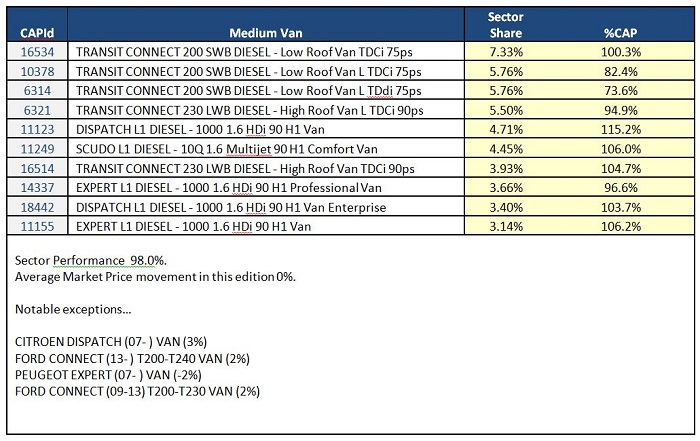

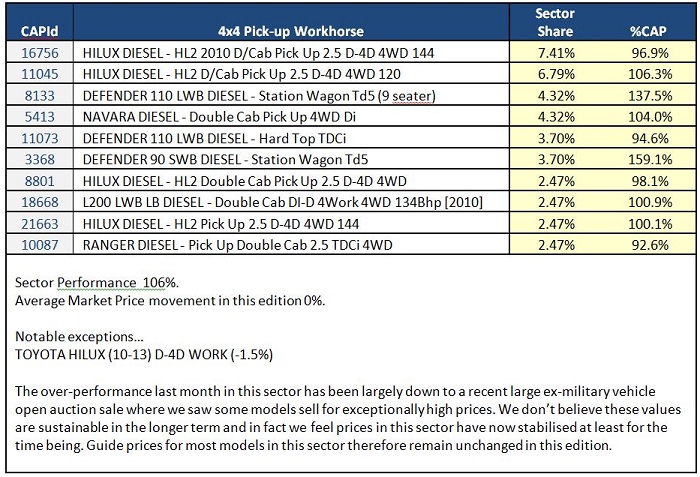

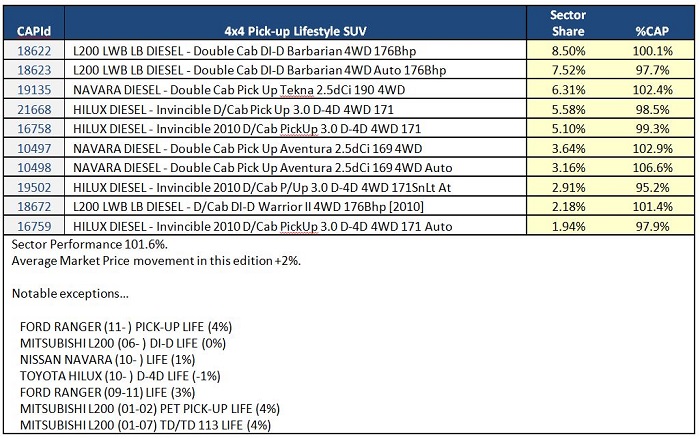

There is only a supply crisis if the demand for vehicles outstrips the used stock that’s on offer both in terms of overall quantity and model mix, so price stability in the used market, as always, will depend on that fragile balance between supply and demand. Clearly during last month the balance tipped in favour of the sellers with average prices rising by around 1.3% but with significant variations in price performance across the sectors. Car-Derived, Light and Medium vans prices fell only marginally whilst Large Panel Vans, Minibuses and 4x4 Pick-ups prices remained strong. A large sale of ex-military vehicles, which included Land Rover Defender and Toyota Hilux, bolstered the 4x4 Workhorse sector with average prices soaring to around 106% of the guide values. However it was noted that the Defenders in that sale were in exceptionally clean condition with relatively low mileages and, given the reputation that ex-military vehicles have for being well looked after, it’s perhaps not surprising they were highly prized.

Looking forward, the latest economic reports indicate that the economy is likely to grow by 3.5% this year which, according the Bank of England, is the best rate of growth seen in around a decade. This growth has been mainly attributed to the largest expansion of services industry seen in almost three years. This is great news for the LCV sector of the motor industry since the services sector is by far the largest consumer of LCVs – new and used.

The mileage and age depreciation rates and price differentials between the various models in the following ranges have been reviewed in this edition. This may have resulted in some significant changes into the guide values for some models