HGV Editorial December 2014

HGV Marketplace

Whilst we receive sales data electronically from all types of routes to market, including auctions, we attend as many auctions as possible each month and independently assess the condition of each vehicle and trailer offered for sale. This provides valuable information relating to the mix and type of vehicles in the market as well as data relating to the source, condition and subsequent sale of the vehicles.

The number of auction entries has decreased this month but on-the-day sales for trucks has risen but only by 1.5%, whilst for trailers it has dropped 1.4%. It should be remembered that these are ‘hammer sales’ on-the-day and any number of provisional bids may be converted post sale.

Some dealers are buying for stock, but most are actively seeking specific vehicles to fulfil enquiries. The continued lack of late plate vehicles remains problematic for many, but so does sourcing good quality older vehicles that can be quickly sold on at a reasonable profit.

Manufacturer sales remain steady but as previously stated it still appears that the motivation in some cases is to move stock rather than achieving the best price. This has become more evident recently because vehicles in stock will become one year older in January and there is a perception that they will therefore lose value after the New Year.

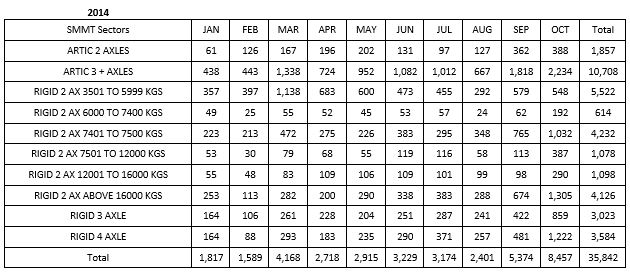

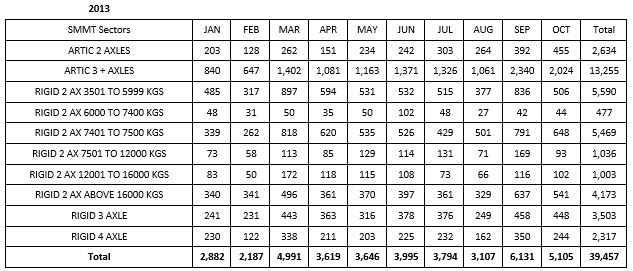

SMMT data to the end of September shows that for the first time this year HGV registrations are higher than for the same month last year. With registrations at just shy of 8,500 October has proved to be the most successful month this year by a long way. The year to date difference has narrowed to just over 3,500 fewer registrations this year compared to 2013. Earlier predictions that this year’s new vehicle registrations would be in the region of 35,000 have already been exceeded.

Details of HGV registrations up to the end of October 2014 compared to the same period last year are illustrated below.

7.5t to 12t Vehicles

Activity in this sector has increased recently whilst not necessarily affecting values. Boxes and curtains are starting to show signs of improvement but it may only be a blip in the run up to Christmas. MAN values have fallen slightly in this sector; this has been reflected in this edition together with a slight decrease in Euro 3 and Euro 4 Fridges.

A significant number of fridges have appeared lately, particularly on Mercedes chassis which have been of varying quality. Whilst this has provided plenty of choice for buyers it has put pressure on values. An equally large batch of tippers on a variety of chassis, but mainly Mitsubishi, proved popular but with so much choice prices may eventually suffer. However, even accounting for seasonality tippers remain sought after.

Due to their current scarcity dropsides have attracted additional interest as have vehicles which are non-standard. A LEZ compliant 2000 V plate Isuzu NQR Boniface recovery vehicle with low warranted miles provoked strong bidding, whilst a couple of 2009 09 plate MAN TGL12.180 crew cab chassis cabs sold well despite their mileage.

13t to 18t Vehicles

Skip loaders, beavertails and tippers have provided the main interest in this sector and with sufficient supply of each many found new homes and as winter approaches tipper/gritters with plough attachments have received increased attention of late. Boxes, curtains and fridges found varying enthusiasm as they appeared and anything non-standard or with a crane attracted additional interest.

Manheim provided another 06 plate DAF FA LF55.250 street lift recovery vehicle with low mileage which again provided vigorous bidding but it failed to sell at anywhere near the example offered a month earlier.

Multi-Wheelers

The endless stream of 6x4 and 8x4 tippers continues unabated and sales remain buoyant, especially those fitted with cranes and grabs where age is not a barrier to a successful outcome. Irrespective of whether muck shift or aggregate specification the worsening weather is doing nothing to supress values. Prices for such vehicles, especially 8x4 examples, remain strong and this has been reflected with a general increase in tipper values this month.

Double drive vehicles of all types, with the exception of refuse trucks, always attract strong interest and apart from tippers there is insufficient supply at present to satisfy the market. Refuse trucks mainly on Dennis and Mercedes Econic chassis continue to appear in numbers and are met with varying bid levels. Due to their high capital cost when new perhaps vendors have unrealistic expectations and consequently many struggle to find buyers. A similar tale could be said for car transporters. Several 10 car transporters have appeared recently, on various chassis and of differing ages. The newest example was a 2009 58 plate DAF CF85.460 sleeper cab chassis coupled to a 2003 Lohr trailer. Like other examples seen it failed to meet the reserve price.

A tidy private plate 2001 Scania 114.380 6x2 sleeper cab cheese-wedge beavertail with a Palfinger PM36024 crane created some excitement at Protruck, whilst a 2012 12 plate DAF XF105.460 Super Space cab drawbar curtain complete with a 2012 trailer, both with full closure tail lifts, provoked strong bidding at CVA.

Tractor Units

The oversupply of tractor units into the marketplace continues and due to a supressed export market vehicles which would have sold easily a few months ago are struggling to find buyers. Despite this buyers continue to show some interest. Mercedes and Volvo’s, especially Actros and FH models, always provoke strong bidding activity although research suggests that even the latter is less sought after than it was a few months ago.

As always anything late registered with a large cab provokes strong interest. Add high horsepower, low kilometres and good condition and bids will be guaranteed to be very strong. The complete lack of such vehicles in any numbers can only help values. On the other hand, occasionally something turns up which unexpectedly produces a good return. This was the case with a 1991 H plate Mercedes 1733 EPS day cab unit with pumping equipment, which, considering its age, sold exceptionally well at Protruck.

The large volumes of three and four year old MAN TGX 26.440’s seems to be abating and after several months of sustained price pressure a decrease in available stock may be helpful.

In summary, the values of older 4x2 tractor units remain reasonably steady but both Euro 4 and Euro 5 values are beginning to show a downward trend. Euro 3 and Euro 4 6x2 tractor units, with the exception of Mercedes, are also starting to show downward pressure whilst Euro 5 vehicles have recently shown a slight increase, with the exception of the MAN TGX. Values have been adjusted this month to reflect this position and we will continue to monitor the situation.

Trailers

Sentiment suggests that the trailer market remains steady. As previously mentioned the best examples which are ready to work are selling but those in poorer condition and requiring work before use are struggling to sell at anything like their true value.

Platforms, especially PSK’s, have been selling strongly of late and we have increased their values this month. Unexpectedly for the time of year, research indicates that values for boxes and curtains are beginning to slide whilst fridges and skeletals are showing a slight increase. We will keep our eye on this to see what happens post-Christmas.

Tippers and anything out of the ordinary attract the most interest. A 2002 King tri-axle stepframe semi low loader provoked strong bidding at the Fleet Auction Group leading to a satisfactory outcome. The same sale saw frenzied bidding on an as new 2014 Nooteboom tri-axle stepframe low loader with SAF axles, disc brakes and a STGO Cat 2 rating.

Industry News

If Government plans come to fruition it is likely that from early next year the speed limit for HGV’s on a single carriageway road will increase from 40mph to 50mph. The new speed limit is intended to reduce accidents caused when frustrated drivers dangerously overtake HGV’s, however, studies suggest that a 50mph speed limit will actually increase accidents and a number of MP’s are opposing the move. It is also believed that an increase in the speed limit will save hauliers money through time saving and lower operating costs and the Government would benefit from increased fuel revenue. A decision to increase the speed limit of HGV’s on dual-carriageways from 50mph to 60 mph is also expected by the end of year. Whatever happens the current speed limits for HGV’s which were introduced in the 1960’s when trucks were arguably less safe than today’s examples, although traffic was much lighter then, are in need of review.

Finally the HGV team at CAP wish all our subscribers a very Happy Christmas and a profitable New Year.

Rob Smith - Red Book Editor, HGV's