HGV Editorial July 2015

HGV Marketplace

Auction attendances continue to struggle reflecting the poor gatherings experienced over the bank holiday periods during May. A few auctions have been well attended but these have been the exception and the age and quality of the vehicles on offer is the obvious reason for good attendances.

Records from our auction visits reveal that the whilst the average number of auction entries increased by 28.1% last month, on-the-day sales for trucks decreased by 11.7% in relation to total entries, but for trailers it increased by 9.0%. As always it should be remembered that these are ‘hammer sales’ on-the-day and any number of provisional bids may be converted post sale.

Auctions have reported that conversions of provisional sales improved last month, one auction reporting that it is currently running at an average conversion rate of 46%. However, there are still plenty of vehicles appearing at recurring sales and those holding older stock are having difficulty finding buyers for them, especially when export buyers have become more selective and newer trucks are preferred.

Dealers report that business is nothing spectacular at present. Worries about what kind of government we would have following the election have now abated and the economy is generally on the up, so we are being told. One dealer said that ‘If the economy is improving why isn’t our trade getting busier?’ This appears to be a fair comment because business is not exactly booming at the moment.

Larger independent dealers are still suffering from the short supply of late stock, some sourcing vehicles direct from manufacturers to fulfil requirements. Manufacturers themselves continue to report brisk sales but cite lack of stock as one reason for the healthy revenues currently being enjoyed.

Research indicates that Euro 4 7.5-12t boxes have shown an increase in value whilst 7.5-12t fridges have seen values fall, this is reflected in this edition. Values of 13-18t boxes and fridges have been moved down, along with multi-wheel fridges. Trailer values have also seen a further adjustment this month to reflect current market conditions.

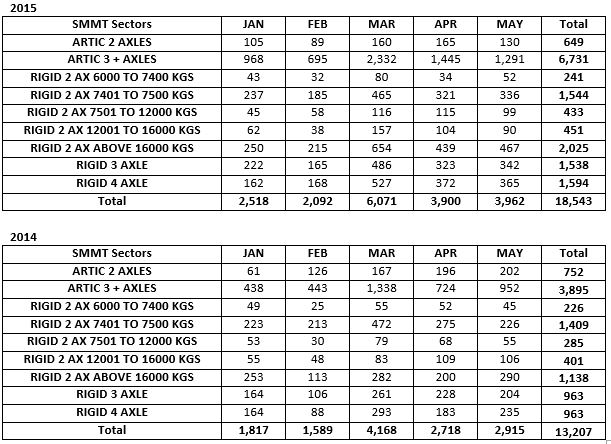

SMMT data for May 2015 shows that the appetite for new trucks over 6 tonnes remains buoyant compared with the same period last year. The largest increases still belong to tri-axle tractor units and rigid vehicles over 16 tonnes.

Details of HGV registrations for 2015 compared to the same period in 2014 are illustrated below.

7.5t to 12t Vehicles

In general older vehicles are starting to find buyers but prices are nothing special and whilst newer examples are selling more easily they are required to have low mileage and be in good condition. Higher mileage and untidy vehicles are not selling so easily and will no doubt be around for a while unless vendors reduce their expectations.

Contrary to last month’s editorial the number of 7.5t fridges has increased again causing values to suffer. Most are of DAF and Mercedes manufacture with varying fridge units. The majority are in a condition that would suggest that a quick sale is unlikely.

With the exception of Euro 4 models which have rallied of late, a large influx of 7.5t boxes has resulted in sluggish sales.

Late vehicles are few and far between and always attract strong bids, particularly curtains. Specialist vehicles remain popular but the appetite for tippers could be on the wane as they have not been selling quite so quickly of late.

13t to 18t Vehicles

Another batch of fridges from the same company have appeared recently and like their smaller stable-mates they are experiencing difficulty finding buyers and values are suffering accordingly, as are those of boxes.

Post 2011 vehicles remain a scarcity so when a small but mixed batch of vehicles from a respected rental company was offered for sale at auction most sold easily creating excitement among the bidders, some of which had travelled considerable distances to attend the sale. Adding value to these vehicles was the vendor, condition, reasonable mileages and full service histories.

Refuse vehicles have proved more popular recently but only those with the right chassis and body combinations which can be put straight to work. Like any other vehicle, those which need reparation work before further use are finding it more difficult to attract buyers.

Several car transporters presented for sale were met with varied interest and failed to achieve their true value whilst a brace of left hand drive sweepers were well received and sold easily when they appeared at auction. Gritter/ploughs, tippers, any kind of tanker and anything sporting a crane remain popular.

Multi-Wheelers

Tippers remain strongest in this sector and age is not always a barrier to a successful sale. Livestock carriers and plant carriers have appeared at sales recently and both guises proved popular. A sprinkling of fuel tankers, along with several dropsides with cranes fared well, along with other specialist offerings.

With a few exceptions the more standard derivatives are not selling so easily, particularly fridges which have seen values weaken.

Refuse vehicles, with high capital cost at new, struggle to achieve their true value, especially those over five or six years old unless they are ready-to-roll. Often two axle refuse trucks with similar specification attract higher values than comparable aged 6x2 and 6x4 examples.

Tractor Units

As always anything late registered with a large cab provokes strong interest. High horsepower, low kilometres, good condition and any variety of driver goodies are guaranteed to provoke strong bidding activity and the complete lack of such vehicles in any numbers can only help maintain healthy values for such vehicles.

There is a surplus of run-of-the-mill tractor units in the market at present and some are proving more difficult than others to dispose of. The continued supply into the market of many similar vehicles is providing buyers with an ever increasing stock to select from.

Despite this buyers continue to show some interest and there is willingness to purchase clean examples. Mercedes and to a lesser extent Volvo always provoke strong bidding activity although research suggests that the latter is less popular than it was a few months ago. The desirability of other marques rests on age, condition and mileage and in some instances colour. Only when such criteria are met are buyers showing their money.

Trailers

There has been little change in the market as trailers continue to become available at a pace which is outstripping sales by a considerable margin. However, research indicates that good quality curtainsiders, tippers, step-frame trailers and skeletals, (especially extenders), are beginning to show some signs of improvement.

Currently there is a wide choice of most common types of trailer to choose from, especially those over ten years of age. Many, including flats, tankers and low loaders are struggling to attract reasonable offers at auction. Although last month showed an improvement in trailer conversion rates at auction a much higher conversion rate is required to clear the large stocks currently held.

The emphasis is currently ‘good quality’ because anything in a condition where it cannot be put straight to work is finding difficulty stimulating any interest. Old, poor quality trailers are plentiful and those that do attract bids are often akin to scrap value.

Rob Smith, Red Book Editor - HGVs